CDT Banco de Bogotá: Transforming Fintech UX

I led the digital transformation of Banco de Bogotá’s CDT experience, boosting digital openings by 30%. This project turned a complex analog process into a seamless mobile-first solution, blending deep research and scalable design

The Challenge: Simplifying CDT Complexity

CDTs are a staple in Colombian banking, but Banco de Bogotá’s digital channel lagged. My mission: craft a user-first experience that educates, reduces friction, and drives adoption within the bank’s ecosystem.

The traditional CDT process at Banco de Bogotá was heavily analog, requiring in-person visits and manual paperwork, which led to inefficiencies and a disjointed user experience. Customers struggled with understanding CDT benefits, lacked transparency around conditions, and faced barriers to renewal or management. The challenge was to create a digital-first experience that simplified the process, educated users, and empowered them to make informed financial decisions—all while aligning with the bank’s operational goals and brand identity.

Research: Decoding Investor Needs

I led a comprehensive research phase to ground the redesign:

Qualitative Insights: Ran 40 interviews and card-sorting sessions to segment users (e.g., risk-averse savers).

Quantitative Data: Analyzed Hotjar heatmaps.

Personas: Built 3 personas with goals like ‘Clear, safe returns.’

Journey Mapping: Charted a 12-step signup, flagging 70% abandonment at document upload.

Stakeholder Alignment: Double Diamond methodology applied to prioritize simplicity.

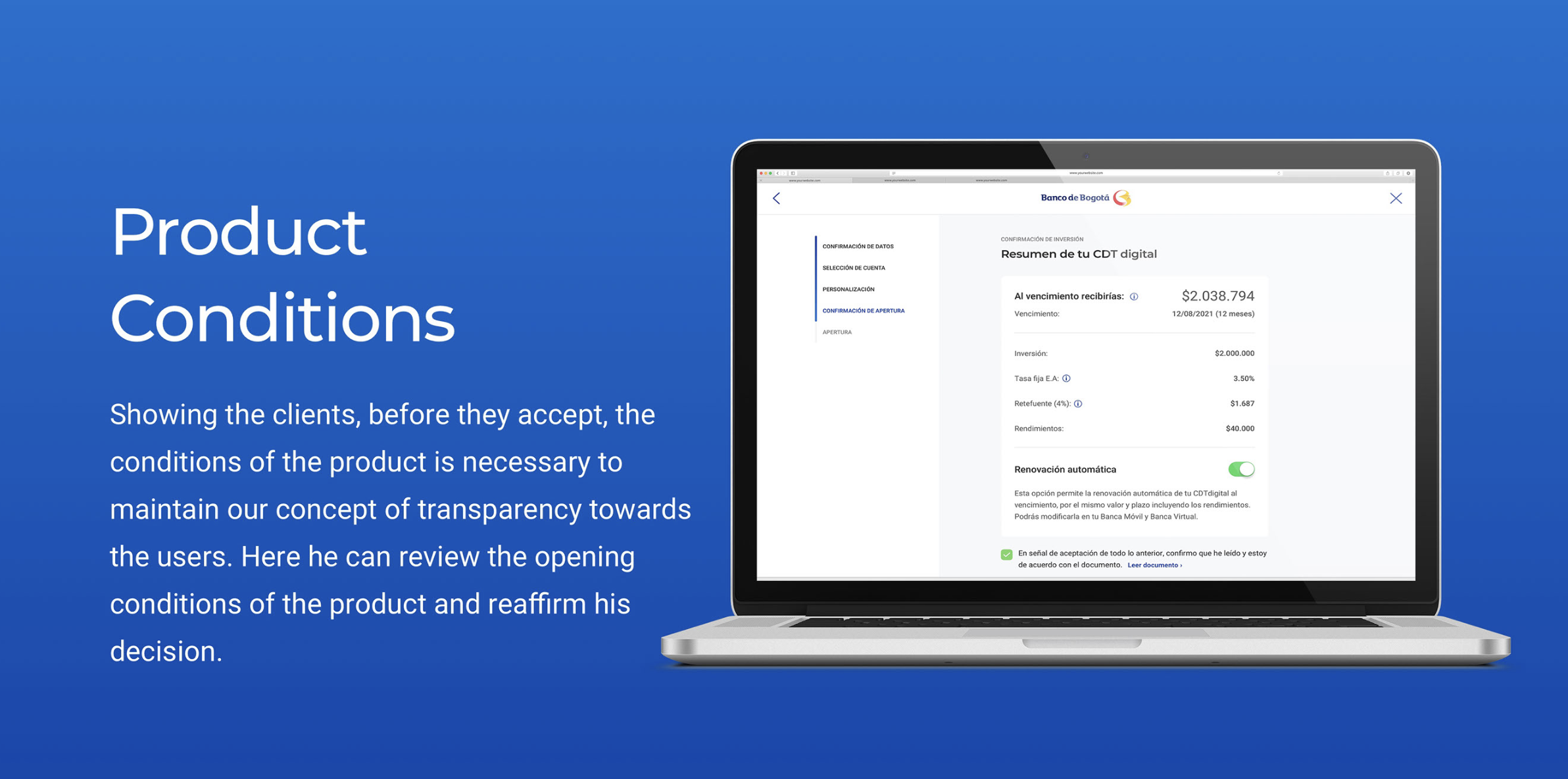

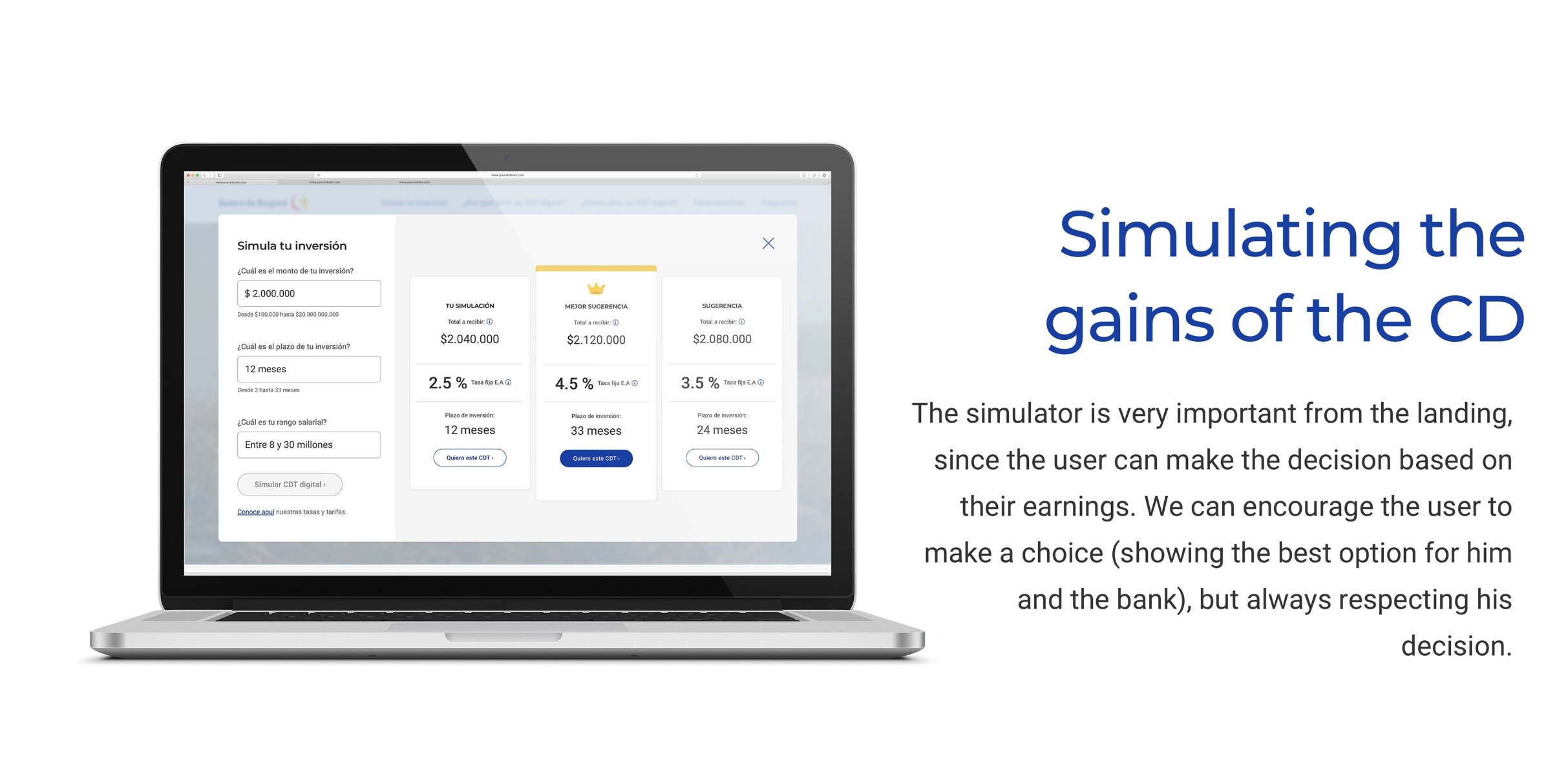

I transformed the analog process into a digital flow, focusing on user education and empowerment. I designed wireframes and prototypes to enable users to simulate gains, select accounts, and review conditions transparently. For example, the "Simulate Your Investment" feature allowed users to input their investment amount and see potential earnings, while the "Product Conditions" screen provided clear terms before confirmation. I used Figma to create high-fidelity prototypes, iterating based on user feedback to refine the experience.

Approach: Precision Meets Scale

I transformed the CDT experience with a fintech-tuned process:

Wireframing: Designed flows in Figma, slashing signup to 3 taps with progressive disclosure.

Design System: Crafted a modular system in Figma, syncing with Banco de Bogotá’s brand.

Micro-Interactions: Added trust-building animations to boost engagement.

After usability testing, I iterated on the designs to address friction points, such as simplifying the account selection process and ensuring transparency in the final summary. The platform was launched as an MVP, allowing users to open a CDT digitally in minutes. Post-launch, I gathered feedback to plan future enhancements, like automated renewals and personalized recommendations, ensuring the solution remained scalable and user-focused.

Solution: Seamless CDT Investing

Simulation Tool: From the landing page, users can simulate their investment gains by inputting their amount and term, empowering them to make informed decisions.

Account Selection: For the MVP, users can select the account to withdraw funds from, streamlining the process.

Transparent Conditions: Before confirming, users review clear product conditions, including rates and fees, fostering trust and transparency.

Educational Content: I incorporated sections like "Why CDT Digital is a Good Option?" to educate users on benefits like capital protection, easy renewal, and accessibility, addressing their concerns.

Impact & Results

A Seamless Fintech Experience.

The CDT Digital platform transformed how Banco de Bogotá customers interact with their financial products. Users can now open a CDT in minutes, with full transparency and control, leading to increased engagement and trust. The simulation tool empowered users to make confident decisions, while the streamlined flow reduced operational overhead for the bank. Post-launch feedback highlighted a 30% increase in CDT openings through the digital channel, proving the success of this user-centered transformation. The platform’s scalability also set the stage for future features like automated renewals and personalized offers.

These high-fidelity designs for Banco de Bogotá’s CDT experience streamline investment onboarding with a focus on transparency and ease. I crafted a mobile-first solution that empowers users to simulate returns, select accounts, and invest confidently—all while aligning with the bank’s digital transformation goals.