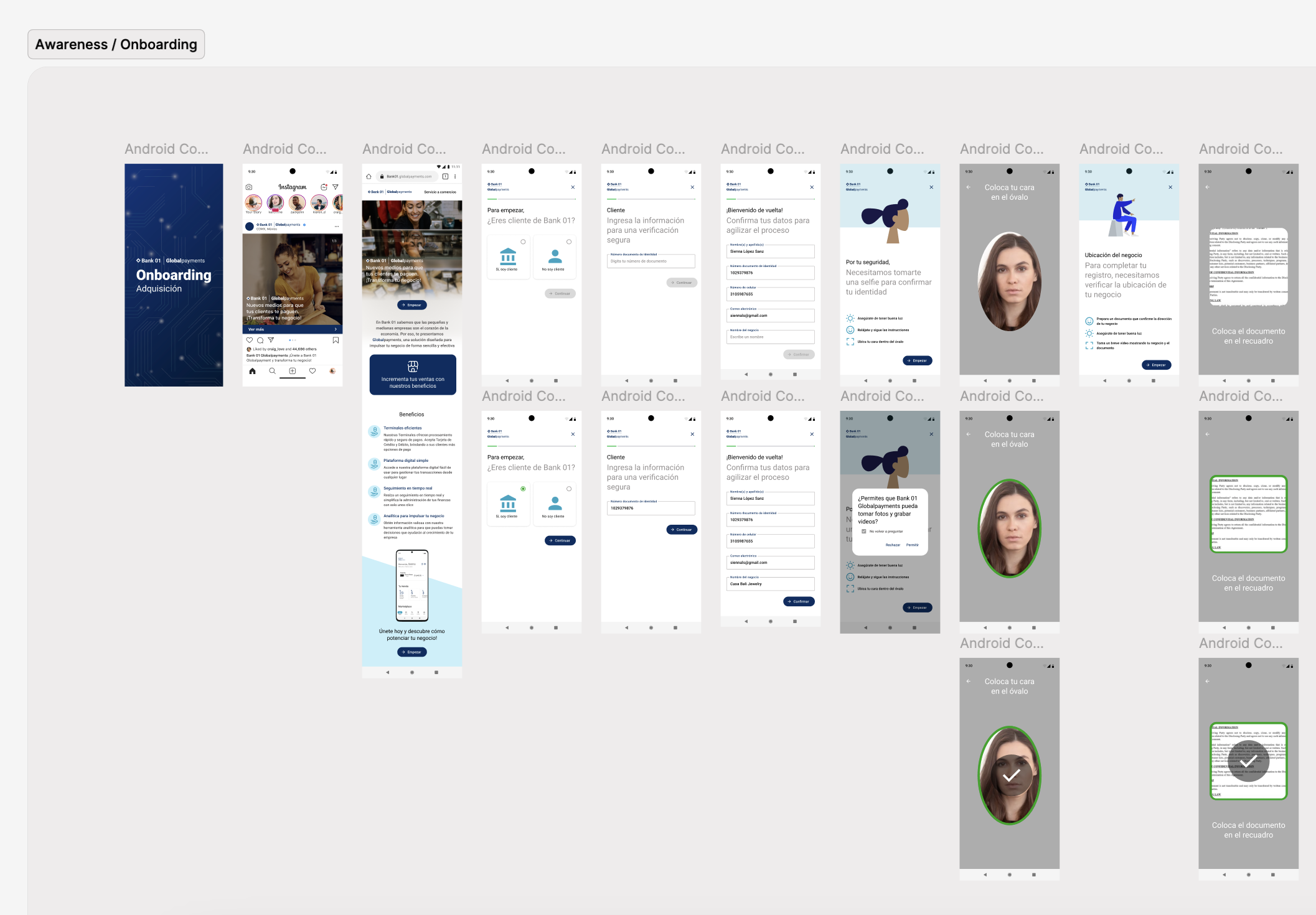

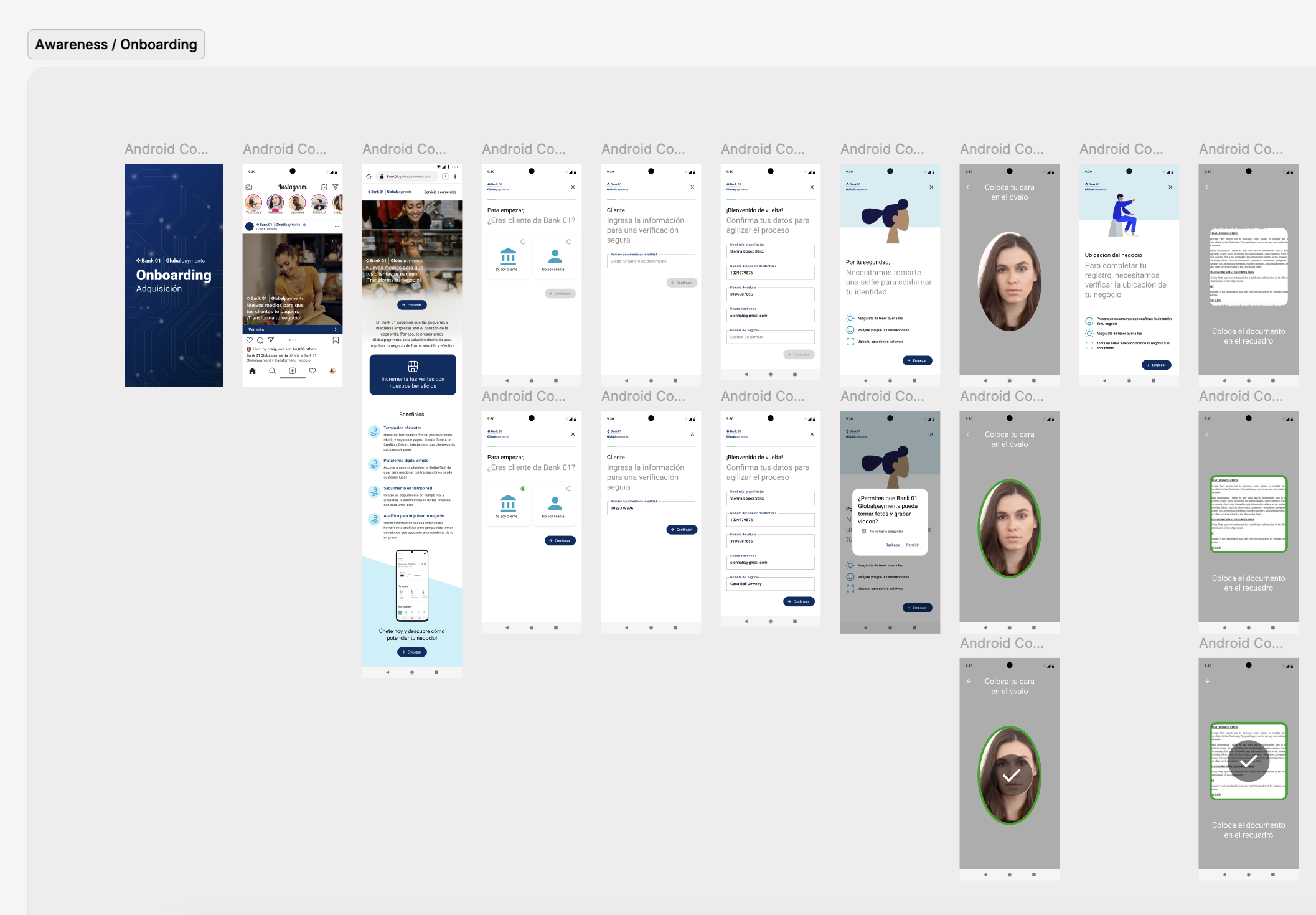

GlobalPayments Acquisition

Empowering Businesses with Payment Solutions

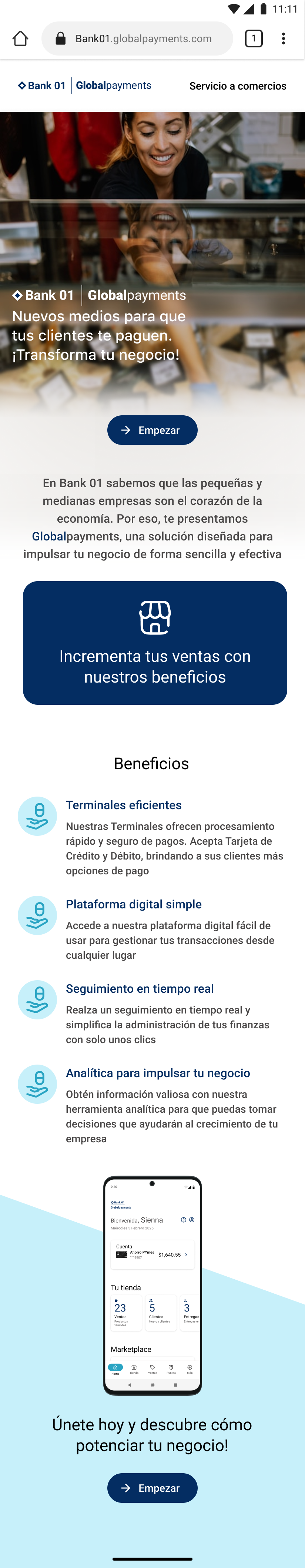

I designed the acquisition module for the GlobalPayments mobile app, developed for Bank 01 GlobalPayments, to enable companies and small businesses to seamlessly integrate diverse payment methods, including POS terminals. The project focused on streamlining the onboarding process for new merchants, ensuring compliance with fiscal requirements, and providing a secure yet intuitive experience to facilitate the adoption of payment solutions. My role encompassed end-to-end design—from user research to prototyping—delivering a solution that simplified business acquisition while enhancing security and usability.

Research & User Insights

To create a user-centered solution, I conducted in-depth research to understand the needs and pain points of small businesses and companies adopting payment methods with Bank 01 GlobalPayments. Here’s how I approached it:

User Personas: I conducted 12 interviews with merchants and surveyed 40 small business owners to identify their behaviors and challenges. This led to the creation of two personas:

Sienna, a 35-year-old small business owner who needs a quick onboarding process and clear terminal selection to start accepting payments within minutes. She struggles with lengthy setup processes and unclear instructions.

Mateo, a 28-year-old manager at a mid-sized company, who requires secure verification and support integration to ensure compliance and operational efficiency.

Empathy Map

I created an empathy map for Sienna to understand her emotions and motivations:

Thinks & Feels: “I need a simple process to start accepting payments quickly.”

Sees: “Other payment apps have more intuitive setups.”

Says & Does: “I get frustrated when the instructions are unclear.”

Hears: “My peers recommend apps that are easier to set up”.

Customer Journey Map

I mapped Sienna’s current journey with payment method adoption to identify pain points:

Stages: Discovery → Onboarding → Document Submission → Terminal Selection → Setup Completion.

Actions: Downloads the app → Creates an account → Submits documents → Selects a payment terminal → Completes setup.

Pain Points: Lengthy onboarding, unclear document submission process, difficulty choosing the right terminal.

Opportunities: Simplify onboarding steps, provide clear document upload guidance, offer guided terminal selection.

Product Ideas

I have co-facilitated a Design Thinking workshop with the product team and stakeholders, using brainstorming and sketching techniques. We generated 15 initial ideas, narrowing them down to 5 for prototyping, including a guided onboarding flow, a terminal recommendation feature, and an in-app support chat.

How Might We (HMW)

Based on the pain points, I formulated HMW questions to guide ideation:

How might we simplify the onboarding process to help Sienna start accepting payments within minutes?

How might we design a terminal selection feature that ensures Sienna chooses the right tool for her business?

How might we provide clear document submission guidance to reduce friction for merchants like Sienna?

The Challenge: Simplifying Payment Method Adoption

Small businesses and companies struggled with the complex process of integrating payment methods with Bank 01 GlobalPayments. Challenges included lengthy onboarding procedures, lack of clarity in selecting the right terminal, and security concerns during verification. The goal was to design a mobile app that simplified the acquisition process, ensured compliance with fiscal requirements, and provided a secure yet intuitive experience for merchants to adopt payment solutions like POS terminals, all while reducing setup time and boosting adoption rates.

Design Process

Wireframing & Prototyping

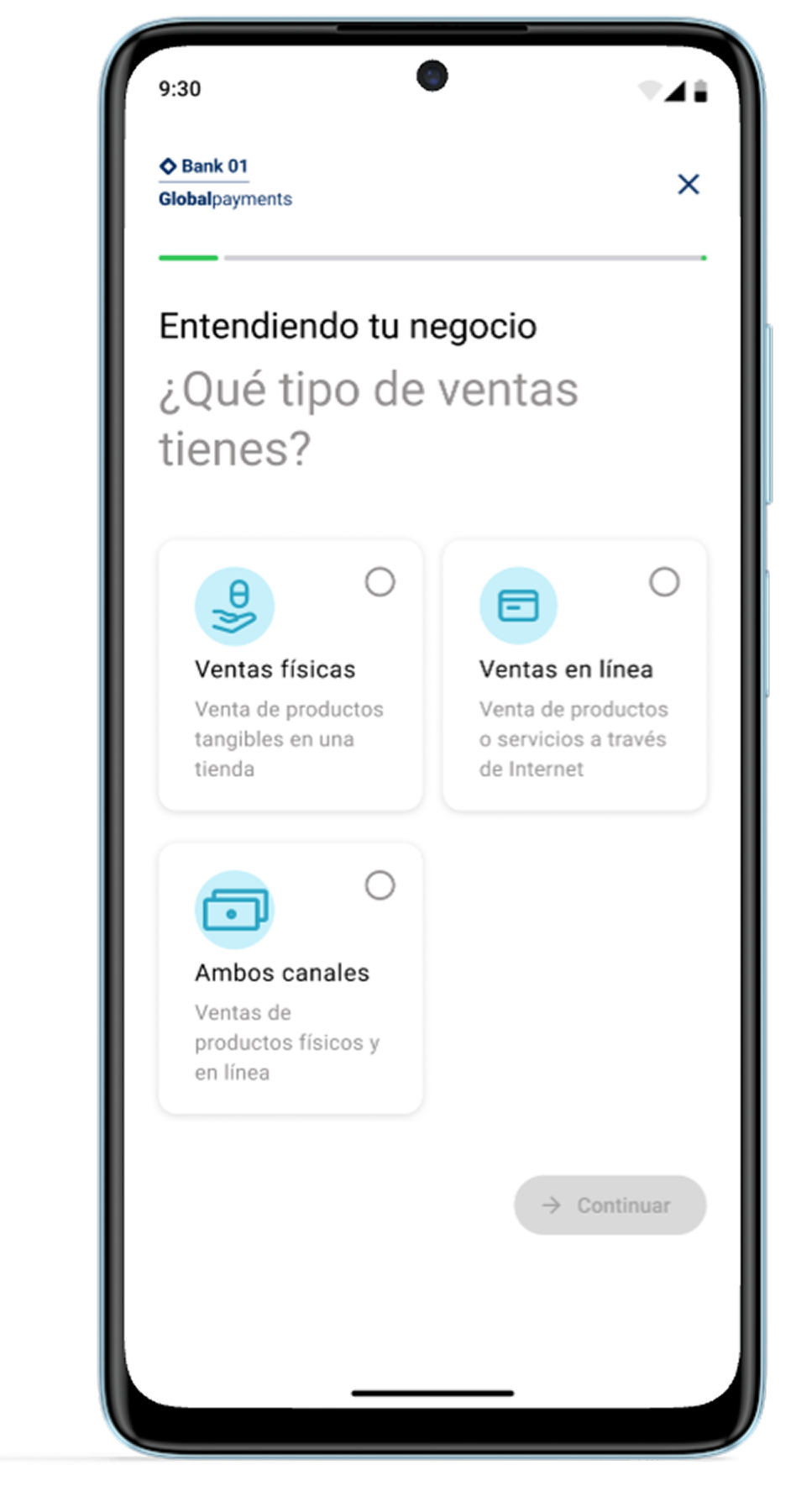

Based on the research insights, storyboards and sketches, I created wireframes to outline the acquisition flow, focusing on steps like location verification, document submission, and terminal setup. Using Figma, I developed high-fidelity prototypes to guide users through the process. For instance, the “Verifica tu ubicación” screen used maps for location validation, while the “Selecciona la terminal ideal” screen allowed merchants to choose the best payment terminal for their needs.

Onboarding & Security Design

A critical component was designing a secure and user-friendly onboarding process. I integrated location verification with map-based interfaces, document upload guidance with clear instructions, and biometric authentication (Face ID and fingerprint) for added security. The “Cliente Ingresa la información” and “Biométricos” screens provided step-by-step guidance, while the “Felicitaciones!” screen celebrated successful onboarding, enhancing user satisfaction and encouraging adoption.

Key Features

Location Verification

Merchants can validate their business location using an interactive map, ensuring compliance with fiscal requirements.

Terminal Selection: A guided interface allows businesses to select the ideal payment terminal based on their needs.

Secure Onboarding: The process includes document uploads and biometric authentication (Face ID and fingerprint), enhancing security while maintaining usability.

Success Feedback: A celebratory “Felicitaciones!” screen confirms successful setup, boosting merchant confidence and encouraging adoption.

Support Integration: Merchants can access help via the “Ayuda” section for assistance during setup, ensuring a smooth experience.

Accelerating Payment Method Adoption: Impacts & Results

The GlobalPayments Acquisition module transformed how companies and small businesses integrate payment methods with Bank 01 GlobalPayments:

The streamlined onboarding process reduced setup time enabling merchants to start accepting payments within minutes.

Adoption rates increased in the first quarter, as the intuitive interface and secure verification built trust.

The terminal selection feature improved the match rate, ensuring businesses chose the right tools for their operations.

Usability testing showed increase in user satisfaction due to the intuitive design and clear guidance.

This project established a scalable foundation for future payment solution rollouts, such as personalized recommendations and advanced analytics.